Adam Malcolm is a consultant with Investors Group Financial Services Inc.

What do you think of when you wonder how to make an impact in your community? Is it supporting a local non-profit? Creating a scholarship for artists? Is it the Income Tax Act? If that last one sounds like it’s coming out of left field, it’s not. When it comes to making your gifts most effective, smart tax planning can turn you from a lame duck to the goose that laid the golden egg.

But let’s take it back a step. Say you’d like to donate some money to a local arts organization. How are you going to do that? Your first thought might be to cut a cheque and donate cash from your savings account.

Here’s how it works – bear with me now while we talk some numbers. The first $200 donated by you will result in a 15 per cent federal tax credit; anything above that will result in a 29 per cent credit of the amount donated (up to 33 per cent if you’re in the highest tax bracket). That’s at the federal level; each province also has their own provincial tax credits at their own rates on top of that.

Now, let’s see this in action. (I’m going to assume, for the sake of ease, that all these examples are from an individual with a 46 per cent combined federal and provincial charitable tax credit and 40 per cent marginal tax rate.)

Let’s start with a donation of simple cash. Say I’m going to patronize my favourite local dance company (a registered not-for-profit) with a gift of $2,500 to mount a new production of Swan Lake. I will write a cheque and the dance company will receive that gift, and I will also receive a tax credit to the amount of $1,150 ($2,500 x 46 per cent combined federal and provincial tax credit = $1,150). Everyone’s happy, right?

Well, what I forgot to think about is that I also have some shares from DucksWorth Ltd. that have been sitting in my non-registered investment account for a while. They’ve done well for me. I originally bought them at $500, but now that investment is worth $2,500. Could I use those to make my gift? Of course, but I want to be very careful about howI donate.

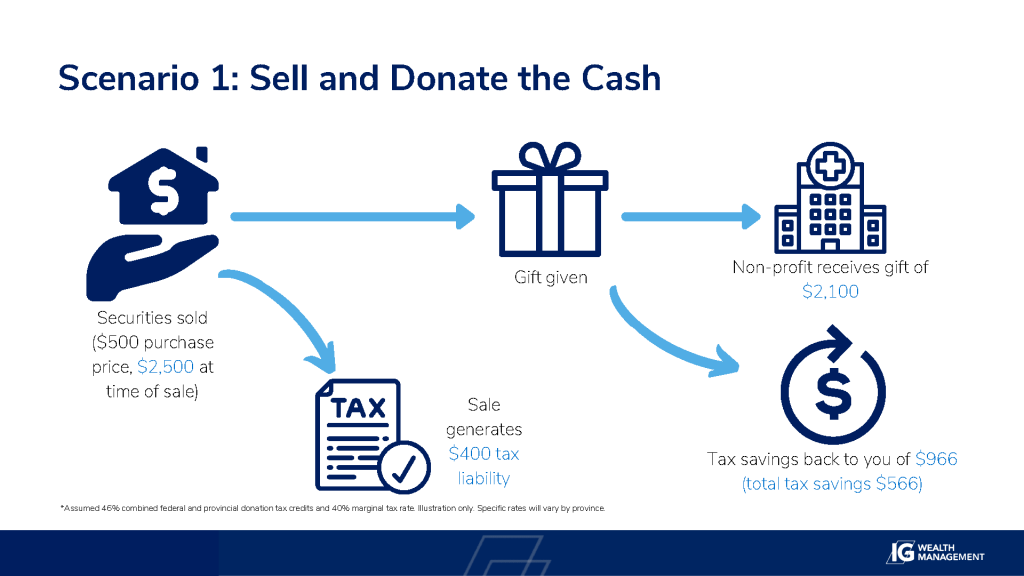

Were I to sell the securities and use that cash to write a cheque like above, this would trigger what’s called a capital gains tax, a tax on half of the investment gain taxed at my highest, or marginal, rate. Put more simply, this sale will leave me with a tax liability of $400 to pay to the Canada Revenue Agency in that year. Furthermore, this tax liability has the unintended consequence of reducing the size of my intended gift to $2,100. Still, a gift is a gift and dancers still receive some scholarship here – and I see a tax savings of $966.

But what if there were another way?

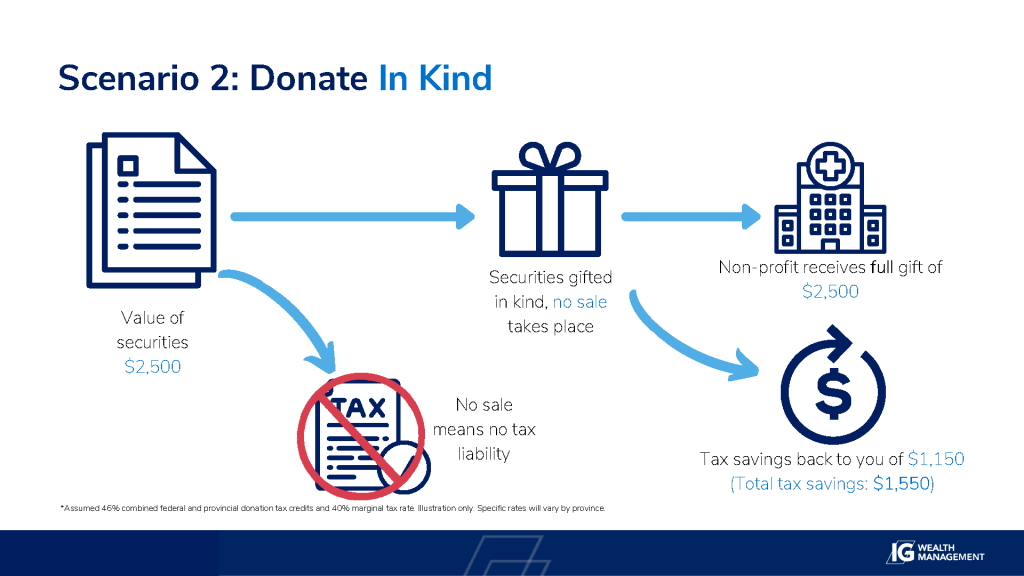

Conveniently, there is! What I could have done is to donate my DucksWorth Ltd. securities directly in what’s called an in-kind donation. Here, rather than sell my shares of DucksWorth, I simply donate the shares themselves to the dance company. The company receives the full value of $2,500 that they can do with as they please, and I will receive the same tax break of $1,150 like I would have with the cash donation example.

Here’s the kicker: by donating in kind, a sale never takes place and that tax liability of $400 is not realized at the time of donation, so I’ve in effect realized a tax savings of $1,550.

Giving a gift to a local charity or arts organization can be one of the greatest ways to support others in our community, but it’s important to think about how a gift can be given in the most efficient way to have maximum impact. By looking at the whole picture and working with an advisor who really understands the importance of holistic financial planning, you win, the non-profit wins and, most importantly, the community wins.

***

This is a general source of information only. It is not intended to provide personalized tax, legal or investment advice and is not intended as a solicitation to purchase securities. Adam Malcolm is solely responsible for its content. For more information on this topic or any other financial matter, please contact an IG Wealth Management consultant. Trademarks, including IG Wealth Management, are owned by IGM Financial Inc. and licensed to its subsidiary corporations.

This article was published with the support of finance sponsor Adam Malcolm.

Tagged: